T4A slips for subcontractors

When you hire subcontractors to help on projects, some subcontractors may not provide proper invoices when they get paid. In the case of a CRA audit, how can you protect yourself and prove that those payments were for subcontractors?

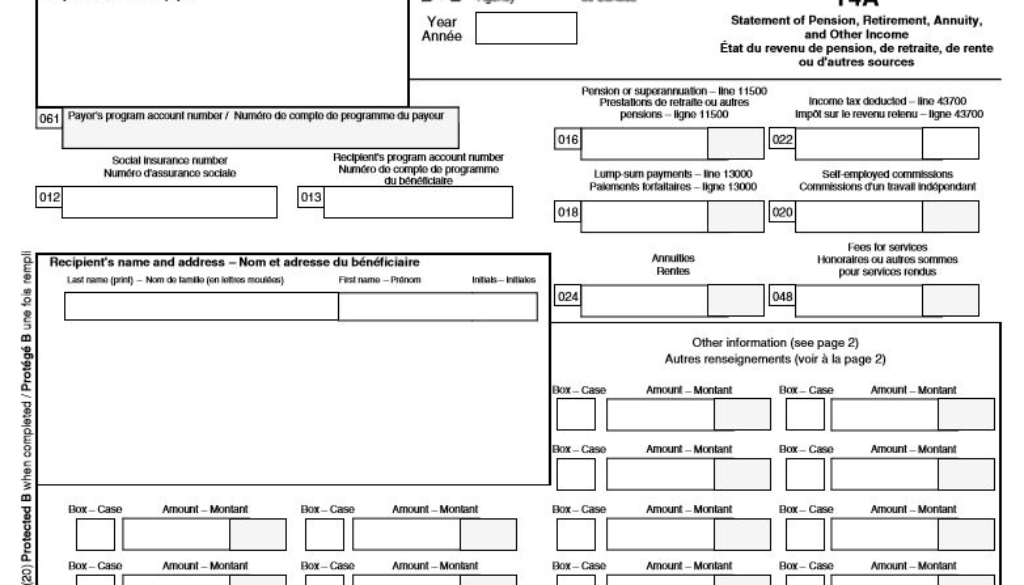

A solution is to issue T4A slips to those individuals who did not provide invoices. You can then report the payments as fees for services in Box 48 of the T4A slip. That slip can then be used as the proof of cost by the T4A issuer. Do remember, the deadline to file T4A slips is the end of February.